- Growth investors are keenly observing SoundHound AI as a potential breakthrough stock similar to Nvidia, which has seen substantial success in AI infrastructure.

- Nvidia is a leader due to its specialized GPUs crucial for AI, with global spending on AI infrastructure predicted to quadruple by 2028.

- SoundHound AI focuses on the burgeoning conversational AI market, holding a 6% share of a sector valued at $14.6 billion, expected to double by 2029.

- Despite its promising market position, SoundHound’s high stock valuation, at 33 times its sales, limits explosive growth potential.

- SoundHound is attractive to those seeking aggressive growth, while others might prefer Nvidia’s stable presence in the AI market.

- SoundHound represents a niche player, offering intriguing opportunities amid AI’s rapid expansion.

Amidst the rapid evolution of the technological landscape, growth investors are sharply attuned to identifying the next Pinterest-worthy stock explosion. As giants like Nvidia continue to skyrocket—turning modest investments in 1999 into fortunes worth millions—there’s a similar current of excitement swirling around SoundHound AI. Both companies are riding the artificial intelligence wave, but can SoundHound follow Nvidia’s meteoric trajectory?

Nvidia’s stunning performance can largely be attributed to its niche dominance in AI infrastructure. With specialized GPUs that serve as the cornerstone for expanding AI capabilities, Nvidia has become synonymous with this technological frontier. The global investment in AI infrastructure paints a vivid picture: a near double in spending within the first half of 2024 alone, reaching a staggering $50 billion mark. This unabated surge, predicted to quadruple by 2028, ensures that Nvidia remains securely at the helm, riding each successive wave of increased demand.

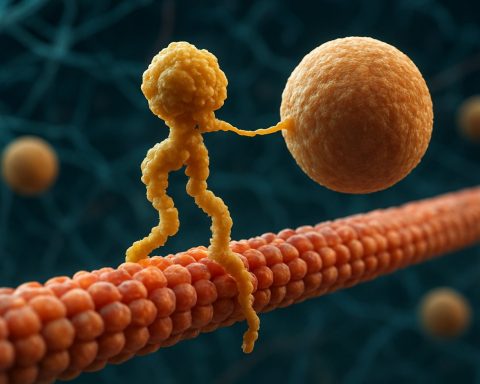

Here’s where SoundHound AI fits into the narrative. Rather than delivering the gears that drive AI engines, SoundHound specializes in making those engines talk. Their focus is the human voice—a realm where interactive AI agents manage everything from customer service queries to imaginative drive-thru orders and even vehicle maintenance interactions.

This sector, termed the “global conversational AI market,” stands at an impressive valuation of $14.6 billion, according to Juniper Research. Already, SoundHound commands a hearty 6% share of this burgeoning market, a percentage that holds significant promise when viewed against the backdrop of a market projected to more than double by 2029. For SoundHound, the upward trajectory isn’t just a possibility; it’s a ticking metronome, counting beats towards its expected revenue boost this decade.

Yet, a key distinction tempers the excitement. SoundHound’s stock, priced at 33 times its sales, staggers under a valuation weight that doesn’t leave much room for breathtaking growth spurts. Although anticipated sales increases for subsequent years are substantial—96% for 2025, then 29% for 2026—these figures are already reflected in its current market price, curbing any explosive potential.

Despite these barriers, the allure of SoundHound is undeniable to aggressive growth seekers who yearn to surf the AI revolution. However, those with a preference for steadier, perhaps more predictable growth, akin to Nvidia’s broad-spectrum AI exposure, might seek sanctuary within more varied investment portfolios.

In this frenzied race to capture AI hegemony, SoundHound resembles a promising, albeit niche sprinter behind Nvidia’s marathon-winning stride. Its saga—woven into the larger tapestry of AI’s relentless ascent—continues to unfold, whispering possibilities into the eager ears of its investors.

Is SoundHound AI the Next Big Thing in AI Investing?

Examining SoundHound AI: More Than Just Talk

As the AI landscape rapidly evolves, investors are keenly focused on discovering the next high-potential stock. SoundHound AI, a leader in voice-enabled AI technology, emerges as a niche standout. While it operates differently from industry giants like Nvidia, SoundHound plays a vital role in the broader AI ecosystem by focusing on conversational AI, a market valued at $14.6 billion and expected to more than double by 2029.

Real-World Use Cases for SoundHound AI

1. Customer Service: AI-driven voice platforms streamline customer interactions, reducing wait times and enhancing user experience.

2. Hospitality and Retail: AI assistants manage orders and requests, integrating seamlessly with existing systems to allow for more personalized interactions.

3. Automotive Industry: Voice-activated controls enhance in-car experiences, making it safer and more convenient to access features while driving.

Market Forecasts & Industry Trends

SoundHound AI’s early capture of a 6% share in the conversational AI market indicates a promising foothold. As voice technology continues to evolve, driven by the proliferation of smart devices, the demand for advanced conversational solutions will likely accelerate. This suggests that SoundHound is well-positioned for growth as these applications become widespread.

Pros & Cons Overview

Pros:

– Market Potential: Positioned within a growing market with promising future trends.

– Innovation in AI: Specialized in conversational AI, a niche with increasing demand.

Cons:

– Valuation Concerns: The high price-to-sales ratio indicates limited potential for dramatic stock growth in the short term.

– Competitive Landscape: Faces competition from larger players with diversified offerings in AI.

Security & Sustainability

SoundHound AI implements robust security measures to protect user data, aligning with industry standards and regulations like GDPR. From a sustainability perspective, AI-powered solutions can reduce energy consumption and improve resource allocation.

Controversies & Limitations

While SoundHound’s focus on voice AI is a growing field, its current valuation might deter risk-averse investors. The company could also face hurdles if larger competitors increase their presence in the conversational AI market.

Tips for Investors

– Diversify: Consider complementing a SoundHound investment with stocks of larger AI companies for balanced exposure.

– Monitor Trends: Stay informed about advancements in AI and voice technologies to better anticipate market shifts.

– Evaluate Risk Tolerance: Assess your comfort with high-valuation stocks and potential market volatility.

For more insights into innovative AI companies and trends, you can visit Juniper Research.

In conclusion, while SoundHound AI may not replicate Nvidia’s explosive trajectory immediately, it occupies a significant niche in the rapidly growing conversational AI market. Its promise lies in capturing innovative applications of voice technology, offering investors a unique opportunity to tap into future AI advancements.