Excimer Laser Micromachining Systems Market Report 2025: In-Depth Analysis of Growth Drivers, Technology Innovations, and Global Opportunities

- Executive Summary and Market Overview

- Key Technology Trends in Excimer Laser Micromachining

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary and Market Overview

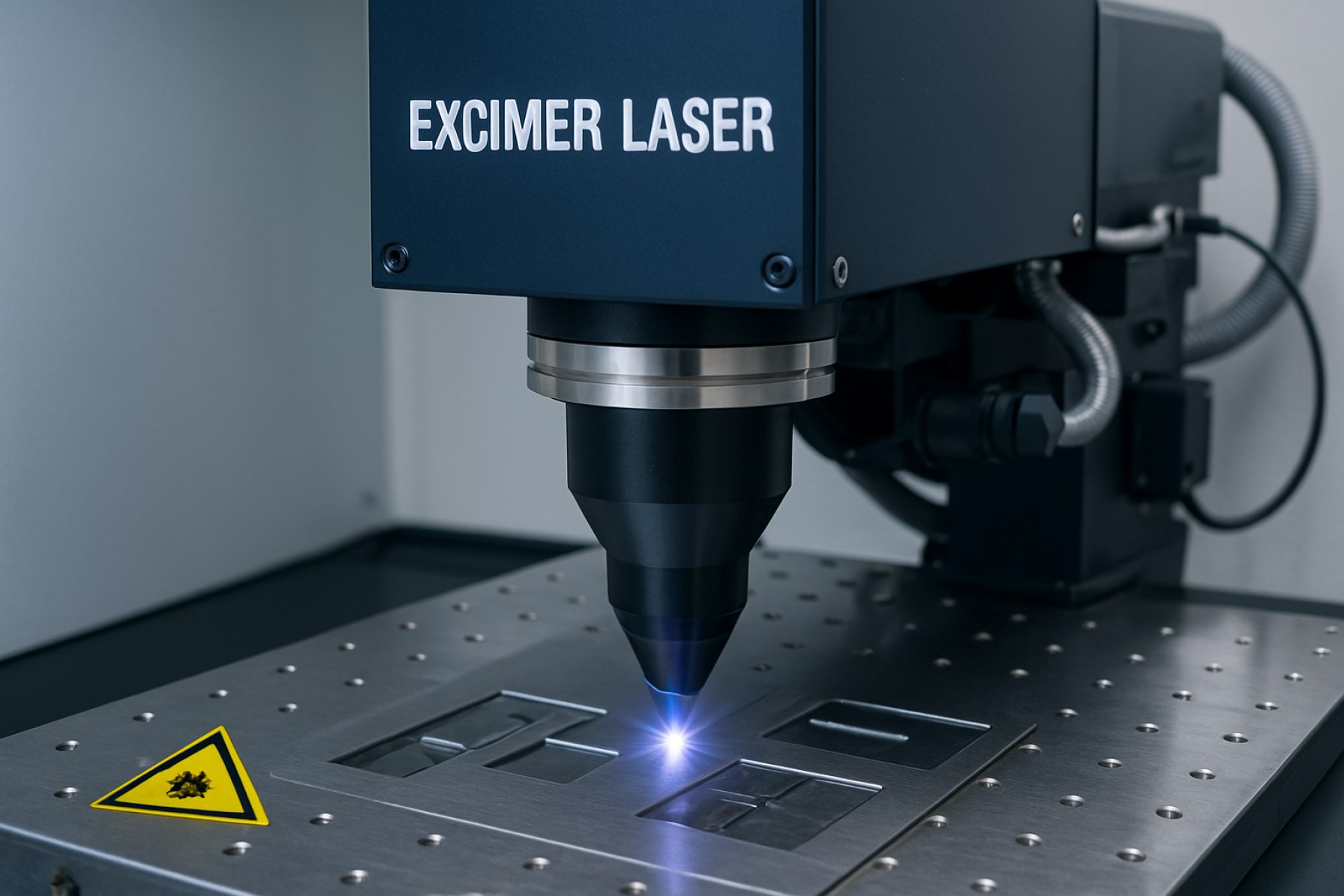

Excimer laser micromachining systems are advanced manufacturing tools that utilize ultraviolet (UV) laser pulses, typically from excimer lasers, to precisely ablate, pattern, or structure materials at the micron and sub-micron scale. These systems are integral to industries such as electronics, medical devices, automotive, and microelectromechanical systems (MEMS), where high-precision material processing is essential. The global market for excimer laser micromachining systems is poised for robust growth in 2025, driven by increasing demand for miniaturized components, advancements in display technologies, and the proliferation of flexible electronics.

According to recent market analyses, the excimer laser micromachining systems market is expected to reach a valuation of approximately USD 1.2 billion by 2025, growing at a compound annual growth rate (CAGR) of around 7% from 2022 to 2025. This growth is underpinned by the expanding adoption of excimer lasers in the production of OLED displays, semiconductor wafers, and medical stents, where their ability to deliver high-precision, non-thermal material removal is unmatched. The Asia-Pacific region, led by countries such as China, Japan, and South Korea, continues to dominate the market due to its strong electronics manufacturing base and significant investments in display and semiconductor fabrication facilities (MarketsandMarkets).

Key industry players, including Coherent Corp., TRUMPF Group, and Lumentum Holdings Inc., are focusing on technological innovations such as shorter pulse durations, higher repetition rates, and improved beam delivery systems to enhance throughput and processing quality. These advancements are enabling new applications in flexible printed circuits, microfluidic devices, and advanced packaging, further expanding the addressable market.

Challenges persist, including high initial capital investment, maintenance costs, and the need for skilled operators. However, ongoing R&D efforts and the integration of automation and AI-driven process controls are expected to mitigate these barriers, making excimer laser micromachining systems more accessible to a broader range of manufacturers (Grand View Research).

In summary, the excimer laser micromachining systems market in 2025 is characterized by strong growth prospects, technological innovation, and expanding end-use applications, positioning it as a critical enabler of next-generation manufacturing across multiple high-tech industries.

Key Technology Trends in Excimer Laser Micromachining

Excimer laser micromachining systems are at the forefront of precision manufacturing, leveraging short-wavelength ultraviolet (UV) laser pulses to achieve high-resolution material processing. As of 2025, several key technology trends are shaping the evolution and adoption of these systems across industries such as electronics, medical devices, and microfluidics.

- Shorter Wavelengths and Pulse Duration: Manufacturers are increasingly developing excimer lasers with shorter wavelengths (e.g., 193 nm ArF and 157 nm F2) and ultra-short pulse durations. These advancements enable finer feature sizes, reduced heat-affected zones, and improved edge quality, which are critical for applications like OLED display patterning and semiconductor wafer processing. The trend toward shorter wavelengths is supported by ongoing R&D investments from companies such as Coherent and Lumentum.

- Integration with Advanced Motion Control: Modern excimer laser micromachining systems are increasingly integrated with high-precision motion stages and real-time feedback systems. This integration allows for sub-micron accuracy and repeatability, essential for high-throughput manufacturing. Companies like Exitech and MKS Instruments are leading in providing such integrated solutions.

- Automated Process Monitoring and AI: The adoption of AI-driven process monitoring and closed-loop control is enhancing system reliability and yield. Real-time data analytics enable predictive maintenance and adaptive process optimization, reducing downtime and improving throughput. TRUMPF and Han’s Laser Technology Industry Group are notable for incorporating AI and IoT capabilities into their excimer laser platforms.

- Green Manufacturing and Energy Efficiency: Environmental considerations are driving the development of excimer laser systems with lower energy consumption and reduced gas usage. Innovations in gas recycling and more efficient power supplies are being implemented to meet stricter sustainability standards, as highlighted in recent reports by MarketsandMarkets.

- Customization and Modular Design: There is a growing demand for modular excimer laser systems that can be tailored to specific application requirements. This trend is particularly evident in the medical device and microelectronics sectors, where rapid prototyping and flexible manufacturing are essential. Jenoptik and Ushio are among the companies offering customizable platforms.

These technology trends are collectively driving the excimer laser micromachining systems market toward greater precision, efficiency, and adaptability, positioning the technology as a cornerstone of next-generation microfabrication.

Competitive Landscape and Leading Players

The competitive landscape of the excimer laser micromachining systems market in 2025 is characterized by a mix of established global players and innovative niche companies, each leveraging technological advancements to capture market share. The sector is marked by high entry barriers due to the complexity of excimer laser technology, stringent quality requirements, and significant R&D investments. Key players are focusing on expanding their product portfolios, enhancing precision, and improving throughput to address the evolving needs of industries such as electronics, medical devices, and automotive manufacturing.

Leading the market are companies like Coherent Corp., TRUMPF Group, and Lumentum Holdings Inc., all of which have a strong global presence and a history of innovation in laser technology. Coherent Corp. continues to dominate with its broad range of excimer laser systems, offering solutions tailored for high-precision micromachining applications, particularly in the semiconductor and display manufacturing sectors. TRUMPF Group leverages its expertise in industrial lasers to provide robust systems with advanced automation and integration capabilities, appealing to high-volume manufacturing environments.

Other significant players include Excelitas Technologies Corp. and JENOPTIK AG, both of which have expanded their excimer laser portfolios through strategic acquisitions and partnerships. These companies are investing in R&D to enhance beam quality, system reliability, and user interface, aiming to differentiate their offerings in a competitive market. Additionally, Hamamatsu Photonics K.K. and Nikon Corporation are notable for their focus on excimer laser sources and integration into advanced lithography and micromachining systems.

- MarketsandMarkets projects continued growth in the excimer laser micromachining segment, driven by demand for miniaturized electronic components and medical devices.

- Strategic collaborations and joint ventures are increasingly common, as companies seek to combine expertise in optics, automation, and software to deliver turnkey solutions.

- Asian manufacturers, particularly from Japan and South Korea, are gaining traction by offering cost-competitive systems with high reliability, intensifying competition for established Western players.

Overall, the 2025 market is defined by rapid innovation, a focus on application-specific solutions, and a dynamic interplay between established leaders and emerging challengers.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The global excimer laser micromachining systems market is projected to experience robust growth between 2025 and 2030, driven by increasing demand for high-precision manufacturing in sectors such as electronics, medical devices, and automotive. According to recent market analyses, the compound annual growth rate (CAGR) for excimer laser micromachining systems is expected to range between 6.5% and 8.2% during this period, reflecting both technological advancements and expanding application areas.

Revenue forecasts indicate that the market, which was valued at approximately USD 410 million in 2024, is anticipated to surpass USD 650 million by 2030. This growth is underpinned by the proliferation of miniaturized electronic components, the rise of flexible and wearable devices, and the increasing adoption of excimer lasers for micro-drilling, patterning, and surface structuring applications. The Asia-Pacific region, led by China, Japan, and South Korea, is expected to maintain its dominance, accounting for over 45% of global revenue by 2030, due to the concentration of electronics manufacturing and ongoing investments in advanced production technologies MarketsandMarkets.

In terms of volume, the number of excimer laser micromachining systems shipped annually is forecasted to grow from approximately 1,800 units in 2025 to over 2,900 units by 2030. This increase is attributed to both replacement demand in mature markets and new installations in emerging economies. The medical device sector, in particular, is expected to register the fastest volume growth, as excimer lasers are increasingly used for stent manufacturing, microfluidic device fabrication, and ophthalmic applications Grand View Research.

- CAGR (2025–2030): 6.5%–8.2%

- Revenue (2030): USD 650+ million

- Volume (2030): 2,900+ units shipped

- Key Growth Drivers: Miniaturization in electronics, medical device innovation, and automotive lightweighting

- Regional Leaders: Asia-Pacific, followed by North America and Europe

Overall, the excimer laser micromachining systems market is set for sustained expansion through 2030, with innovation in laser sources, system integration, and process automation further accelerating adoption across high-growth industries Fortune Business Insights.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global excimer laser micromachining systems market demonstrates distinct regional dynamics, shaped by technological adoption, end-user industries, and investment in advanced manufacturing. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each contribute uniquely to market growth and innovation.

- North America: North America remains a leading market, driven by robust demand from the semiconductor, medical device, and electronics sectors. The United States, in particular, benefits from a strong R&D ecosystem and the presence of major industry players such as Coherent and Lumentum. The region’s focus on miniaturization and precision manufacturing, especially for microelectronics and advanced medical implants, sustains high adoption rates. According to SEMI, North American semiconductor equipment billings are projected to grow steadily through 2025, supporting excimer laser system demand.

- Europe: Europe’s market is characterized by strong regulatory standards and a focus on high-precision applications in automotive, aerospace, and medical technology. Countries like Germany and Switzerland are home to key manufacturers such as TRUMPF and Rofin-Sinar. The European Union’s investments in Industry 4.0 and microfabrication research, as highlighted by European Commission reports, are expected to drive further adoption of excimer laser micromachining systems in 2025.

- Asia-Pacific: Asia-Pacific is the fastest-growing region, propelled by the rapid expansion of electronics manufacturing in China, South Korea, Taiwan, and Japan. The region’s dominance in semiconductor fabrication and display panel production, as reported by SEMI, underpins significant investments in advanced micromachining technologies. Local players and global suppliers are expanding capacity to meet the surging demand for high-precision laser systems in consumer electronics, automotive, and medical device manufacturing.

- Rest of World (RoW): The RoW segment, including Latin America, the Middle East, and Africa, is emerging as a niche market. Growth is primarily driven by increasing investments in healthcare infrastructure and the gradual adoption of advanced manufacturing technologies. While market penetration remains lower compared to other regions, initiatives to localize electronics and medical device production are expected to create new opportunities for excimer laser micromachining system suppliers.

Overall, regional market trends in 2025 reflect a combination of established industrial bases, regulatory environments, and evolving end-user demands, with Asia-Pacific poised for the most rapid expansion in excimer laser micromachining system adoption.

Future Outlook: Emerging Applications and Investment Hotspots

Looking ahead to 2025, the excimer laser micromachining systems market is poised for significant evolution, driven by both technological advancements and the emergence of new application domains. The unique ability of excimer lasers to deliver high-precision, cold ablation with minimal thermal damage continues to unlock opportunities in sectors demanding micro-scale fabrication and patterning.

One of the most promising emerging applications is in the production of advanced medical devices, particularly in microfluidics and biochip manufacturing. The demand for point-of-care diagnostics and lab-on-a-chip solutions is accelerating, with excimer lasers enabling the precise structuring of polymers and glass substrates required for these devices. This trend is supported by increased investment in healthcare innovation, especially in Asia-Pacific and North America, where government and private funding for medical technology startups is robust (MedTech Dive).

Another hotspot is the semiconductor and display industry, where excimer laser annealing and patterning are critical for next-generation OLED and microLED displays. As consumer electronics manufacturers push for higher resolution and thinner form factors, excimer laser micromachining systems are being adopted for their ability to process delicate materials with sub-micron accuracy. The ongoing transition to advanced packaging and heterogeneous integration in semiconductor manufacturing is also expected to drive demand (SEMI).

In the realm of flexible electronics and wearable devices, excimer lasers are increasingly used for patterning flexible substrates and transparent conductive films. The growth of the Internet of Things (IoT) and smart textiles is fueling R&D and capital investment in this area, with several leading electronics firms expanding their excimer laser processing capabilities (IDTechEx).

Geographically, Asia-Pacific remains the dominant investment hotspot, led by China, Japan, and South Korea, where government-backed initiatives and strong manufacturing ecosystems support rapid adoption. Europe and North America are also seeing increased activity, particularly in high-value applications such as aerospace, automotive microcomponents, and photonics.

In summary, the future outlook for excimer laser micromachining systems in 2025 is characterized by diversification into new high-growth applications and sustained investment in regions with strong innovation ecosystems. Companies that can offer tailored solutions for emerging sectors and invest in R&D for next-generation laser sources are likely to capture significant market share.

Challenges, Risks, and Strategic Opportunities

The excimer laser micromachining systems market in 2025 faces a complex landscape of challenges, risks, and strategic opportunities shaped by technological evolution, regulatory dynamics, and shifting end-user demands. One of the primary challenges is the high initial capital investment required for excimer laser systems, which can limit adoption among small and medium-sized enterprises (SMEs). The cost barrier is compounded by ongoing maintenance expenses and the need for skilled operators, creating a significant entry hurdle for new market participants.

Another risk is the rapid pace of technological change. As femtosecond and picosecond laser technologies advance, they increasingly compete with excimer lasers in applications such as microelectronics, medical device manufacturing, and precision engineering. This technological substitution risk requires excimer laser system manufacturers to invest heavily in R&D to maintain performance advantages, such as superior edge quality and minimal thermal damage, which are critical in applications like OLED display patterning and microfluidics fabrication (Coherent Corp.).

Supply chain vulnerabilities also pose a significant risk, particularly in the procurement of rare gases (e.g., krypton, xenon) and specialized optical components. Geopolitical tensions and disruptions in global logistics can lead to price volatility and delays, impacting production schedules and profitability (Linde plc). Additionally, stringent environmental and safety regulations regarding the handling and disposal of toxic gases used in excimer lasers add compliance costs and operational complexity, especially in regions with evolving regulatory frameworks (U.S. Environmental Protection Agency).

Despite these challenges, strategic opportunities abound. The ongoing miniaturization trend in electronics and the proliferation of advanced medical devices are driving demand for high-precision micromachining. Emerging applications in flexible electronics, microfluidics, and next-generation semiconductor packaging present lucrative growth avenues. Companies that can offer integrated solutions—combining excimer lasers with advanced automation, real-time process monitoring, and AI-driven optimization—are well-positioned to capture market share (TRUMPF Group).

Strategic partnerships with research institutions and end-users can accelerate innovation and application development, while geographic expansion into Asia-Pacific, where electronics manufacturing is booming, offers significant growth potential. Ultimately, the ability to balance cost, performance, and compliance will determine which players thrive in the evolving excimer laser micromachining systems market in 2025.

Sources & References

- MarketsandMarkets

- Coherent Corp.

- TRUMPF Group

- Lumentum Holdings Inc.

- Grand View Research

- Exitech

- Han’s Laser Technology Industry Group

- Jenoptik

- Ushio

- Hamamatsu Photonics K.K.

- Nikon Corporation

- Fortune Business Insights

- Rofin-Sinar

- European Commission

- MedTech Dive

- IDTechEx

- Linde plc