Graphene-Polymer Integration Technologies Market Report 2025: In-Depth Analysis of Growth Drivers, Innovations, and Global Opportunities. Explore Key Trends, Forecasts, and Strategic Insights Shaping the Industry.

- Executive Summary & Market Overview

- Key Technology Trends in Graphene-Polymer Integration

- Market Size, Segmentation, and Growth Forecasts (2025–2030)

- Competitive Landscape and Leading Players

- Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Emerging Applications and End-User Insights

- Challenges, Risks, and Barriers to Adoption

- Opportunities and Strategic Recommendations

- Future Outlook: Innovation Pathways and Market Evolution

- Sources & References

Executive Summary & Market Overview

Graphene-polymer integration technologies represent a rapidly advancing segment within the advanced materials market, leveraging the exceptional mechanical, electrical, and thermal properties of graphene to enhance the performance of polymer matrices. As of 2025, these technologies are at the forefront of innovation, enabling the development of next-generation composites for applications spanning electronics, automotive, aerospace, energy storage, and biomedical devices.

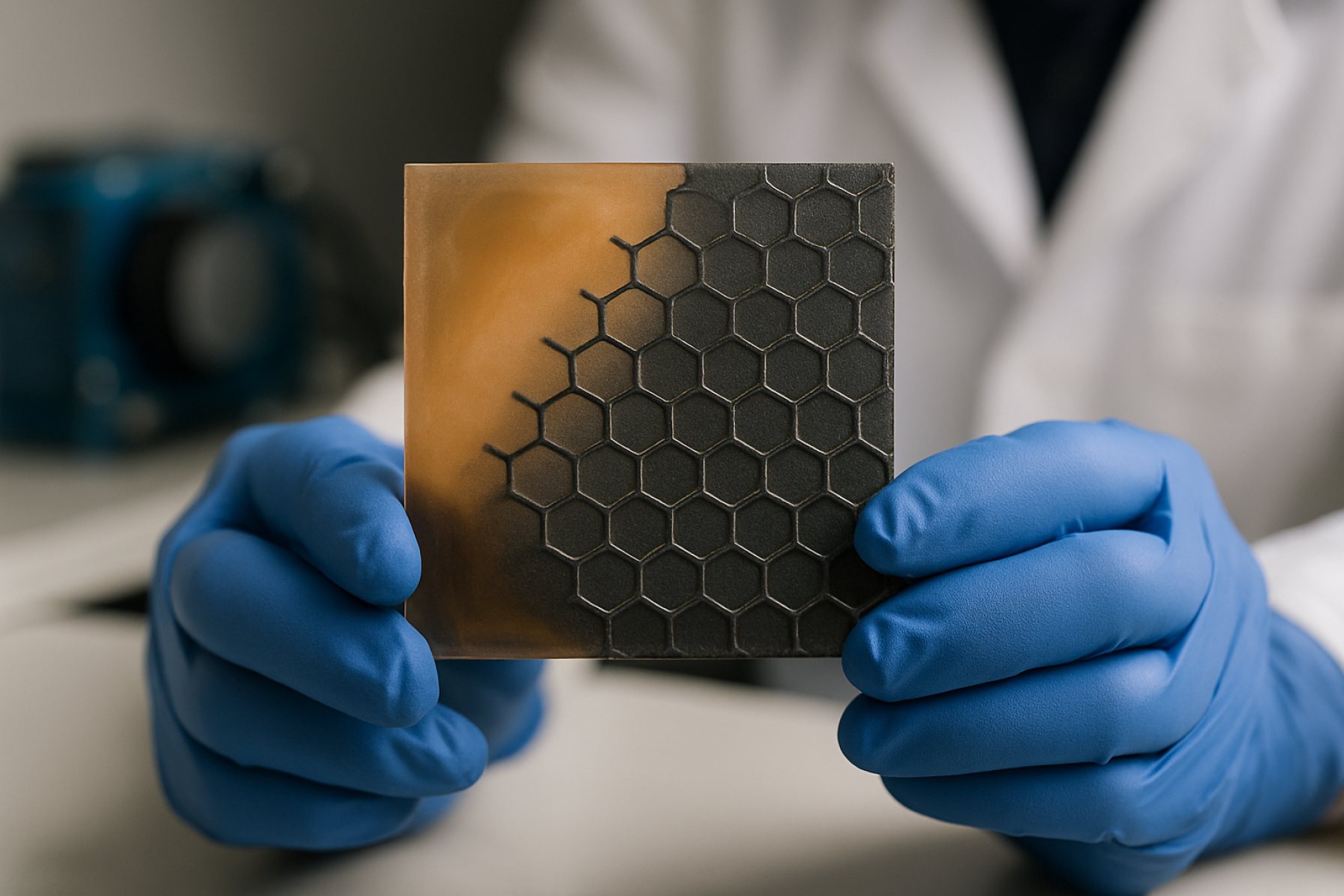

Graphene, a single layer of carbon atoms arranged in a two-dimensional lattice, is renowned for its extraordinary strength, conductivity, and flexibility. When integrated into polymers, even at low loadings, graphene can significantly improve tensile strength, electrical conductivity, thermal stability, and barrier properties. The integration process involves various techniques, including solution mixing, in-situ polymerization, melt blending, and layer-by-layer assembly, each offering distinct advantages in terms of scalability, dispersion quality, and cost-effectiveness.

The global market for graphene-polymer composites is experiencing robust growth, driven by increasing demand for lightweight, high-performance materials. According to MarketsandMarkets, the graphene composites market is projected to reach USD 875 million by 2025, with a compound annual growth rate (CAGR) exceeding 40%. This surge is fueled by the automotive and aerospace sectors’ pursuit of materials that offer superior strength-to-weight ratios and enhanced durability, as well as the electronics industry’s need for advanced conductive polymers.

Key industry players, such as Directa Plus, XG Sciences, and Versarien, are actively commercializing graphene-polymer integration technologies, focusing on scalable production methods and tailored composite solutions. Strategic collaborations between material suppliers and end-use manufacturers are accelerating the adoption of these technologies, particularly in the development of flexible electronics, high-performance coatings, and next-generation batteries.

Despite the promising outlook, challenges remain in achieving uniform graphene dispersion, optimizing interfacial bonding, and reducing production costs. Ongoing research and development efforts, supported by organizations such as Graphene Flagship, are addressing these hurdles, aiming to unlock the full commercial potential of graphene-polymer integration. As the technology matures, it is poised to play a pivotal role in the evolution of advanced materials across multiple industries.

Key Technology Trends in Graphene-Polymer Integration

Graphene-polymer integration technologies are rapidly evolving, driven by the need to harness graphene’s exceptional mechanical, electrical, and thermal properties within scalable polymer matrices. In 2025, several key technology trends are shaping the landscape of graphene-polymer composites, focusing on improved dispersion, functionalization, and scalable manufacturing processes.

- Advanced Dispersion Techniques: Achieving uniform dispersion of graphene within polymers remains a critical challenge. Recent advancements include the use of surfactant-assisted exfoliation, in-situ polymerization, and high-shear mixing, which enhance the interfacial bonding and prevent agglomeration. These methods are being refined to enable industrial-scale production while maintaining the intrinsic properties of graphene. For instance, BASF and SABIC are investing in proprietary dispersion technologies to improve composite performance and consistency.

- Chemical Functionalization: Surface modification of graphene through covalent and non-covalent functionalization is gaining traction. This approach tailors the compatibility of graphene with various polymer matrices, enhancing load transfer and electrical conductivity. Companies like Directa Plus are commercializing functionalized graphene nanoplatelets for use in thermoplastics and thermosets, targeting automotive and electronics applications.

- 3D Printing and Additive Manufacturing: The integration of graphene into printable polymer filaments is enabling the production of complex, high-performance components via additive manufacturing. In 2025, research and commercial efforts are focused on optimizing graphene loading levels to balance printability with enhanced mechanical and conductive properties. XG Sciences and Graphenea are at the forefront, supplying graphene-enhanced filaments for prototyping and end-use parts.

- Scalable Production and Cost Reduction: The transition from laboratory-scale to industrial-scale production is a major trend. Continuous processes such as melt compounding and solution blending are being adopted to lower costs and improve throughput. According to IDTechEx, these scalable methods are critical for the commercialization of graphene-polymer composites in sectors like packaging, automotive, and consumer electronics.

Collectively, these technology trends are accelerating the adoption of graphene-polymer integration, paving the way for next-generation materials with superior performance and new functionalities across multiple industries.

Market Size, Segmentation, and Growth Forecasts (2025–2030)

The global market for graphene-polymer integration technologies is poised for robust expansion between 2025 and 2030, driven by escalating demand for advanced composite materials across sectors such as automotive, aerospace, electronics, and energy storage. In 2025, the market size is estimated to reach approximately USD 1.2 billion, with a projected compound annual growth rate (CAGR) of 28–32% through 2030, potentially surpassing USD 4.5 billion by the end of the forecast period. This growth is underpinned by the increasing adoption of graphene-enhanced polymers for their superior mechanical, thermal, and electrical properties compared to conventional polymer composites.

Segmentation within the graphene-polymer integration technologies market is primarily based on:

- Type of Polymer Matrix: Thermoplastics (e.g., polyethylene, polypropylene), thermosets (e.g., epoxy, polyester), and elastomers are the main categories. Thermoplastics currently dominate due to their processability and compatibility with graphene, accounting for over 45% of market share in 2025.

- Integration Method: Key technologies include solution mixing, melt blending, in-situ polymerization, and layer-by-layer assembly. Melt blending is gaining traction for its scalability and cost-effectiveness, especially in automotive and packaging applications.

- End-Use Industry: Automotive and transportation lead the market, leveraging graphene-polymer composites for lightweighting and enhanced durability. Electronics and energy storage (notably batteries and supercapacitors) are rapidly growing segments, with electronics expected to register the highest CAGR (over 35%) through 2030.

- Geography: Asia-Pacific is the largest and fastest-growing regional market, driven by significant investments in advanced materials manufacturing in China, South Korea, and Japan. North America and Europe follow, with strong R&D activity and early adoption in high-value industries.

Growth forecasts are supported by ongoing advancements in scalable graphene production, improved dispersion techniques, and increasing regulatory approvals for commercial use. Strategic collaborations between graphene producers and polymer manufacturers are accelerating technology transfer and market penetration. However, challenges such as high production costs, standardization issues, and the need for consistent quality control may temper growth in the short term.

Overall, the period from 2025 to 2030 is expected to witness a transition from pilot-scale projects to large-scale commercialization, with the market’s trajectory shaped by technological innovation and expanding application horizons.MarketsandMarkets IDTechEx Grand View Research

Competitive Landscape and Leading Players

The competitive landscape for graphene-polymer integration technologies in 2025 is characterized by a dynamic mix of established chemical conglomerates, innovative startups, and academic spin-offs, all vying for leadership in a rapidly evolving market. The sector is driven by the demand for advanced composites in automotive, aerospace, electronics, and energy storage applications, where the unique properties of graphene—such as high electrical conductivity, mechanical strength, and thermal stability—can significantly enhance polymer matrices.

Key players in this space include BASF SE, which has invested heavily in R&D for graphene-enhanced polymers, focusing on scalable production methods and integration into existing polymer processing lines. Haydale Graphene Industries is notable for its proprietary functionalization processes, enabling better dispersion of graphene within thermoplastics and thermosets, which is critical for achieving consistent material performance at scale.

Another significant player, Directa Plus, has developed patented technologies for producing and integrating graphene nanoplatelets into elastomers and polyolefins, targeting sectors such as automotive interiors and sports equipment. XG Sciences continues to expand its portfolio of graphene-enhanced polymer masterbatches, collaborating with OEMs to tailor solutions for specific end-use requirements.

Startups and university spin-offs are also shaping the competitive landscape. Graphenea and Versarien plc are leveraging proprietary synthesis and dispersion techniques to address challenges in uniform graphene distribution and interfacial bonding within polymer matrices. These companies often partner with research institutions to accelerate commercialization and validate performance in real-world applications.

Strategic collaborations and licensing agreements are common, as companies seek to combine expertise in graphene production with polymer processing know-how. For example, SABIC has entered into partnerships with nanomaterial specialists to co-develop graphene-polymer composites for high-performance engineering plastics.

Overall, the competitive environment is marked by rapid innovation, with intellectual property portfolios and scalable manufacturing capabilities serving as key differentiators. As end-user industries increasingly demand lightweight, multifunctional materials, the ability to deliver consistent, cost-effective graphene-polymer integration will determine market leadership in 2025 and beyond.

Regional Analysis: North America, Europe, Asia-Pacific, and Rest of World

The regional landscape for graphene-polymer integration technologies in 2025 is shaped by varying levels of research intensity, industrial adoption, and regulatory support across North America, Europe, Asia-Pacific, and the Rest of the World. Each region demonstrates unique drivers and challenges influencing the commercialization and scaling of these advanced materials.

North America remains a leader in graphene-polymer integration, propelled by robust R&D ecosystems and strong venture capital activity. The United States, in particular, benefits from collaborations between academic institutions and industry, with companies such as Versarien and XG Sciences advancing applications in automotive, aerospace, and electronics. The region’s regulatory environment, including support from agencies like the National Science Foundation, fosters innovation but also imposes strict safety and environmental standards, influencing the pace of commercialization.

Europe is characterized by coordinated public-private initiatives and a strong emphasis on sustainability. The European Union’s Graphene Flagship project continues to drive integration technologies, focusing on scalable production and eco-friendly composites. European manufacturers are increasingly incorporating graphene-polymer materials in automotive lightweighting and renewable energy sectors. However, regulatory complexities and the need for harmonized standards across member states can slow market entry for new technologies.

Asia-Pacific is the fastest-growing region for graphene-polymer integration, led by China, Japan, and South Korea. China’s aggressive investment in graphene research, supported by the National Natural Science Foundation of China, has resulted in rapid commercialization, particularly in consumer electronics and energy storage. Japanese firms such as Mitsubishi Chemical Holdings and South Korean conglomerates are leveraging graphene-polymer composites for advanced batteries and flexible displays. The region’s manufacturing prowess and government incentives are accelerating adoption, though concerns about intellectual property and quality control persist.

- Rest of the World includes emerging markets in Latin America, the Middle East, and Africa, where adoption is nascent but growing. Brazil and the UAE are investing in pilot projects for construction and packaging applications, often in partnership with international technology providers. Limited local expertise and infrastructure remain barriers, but international collaborations are expected to drive gradual uptake.

Overall, regional disparities in research funding, industrial capacity, and regulatory frameworks will continue to shape the global trajectory of graphene-polymer integration technologies through 2025 and beyond.

Emerging Applications and End-User Insights

Graphene-polymer integration technologies are rapidly evolving, unlocking new applications across diverse industries by leveraging the unique properties of graphene—such as exceptional mechanical strength, electrical conductivity, and thermal stability—within polymer matrices. In 2025, the market is witnessing a surge in both research and commercialization efforts aimed at optimizing dispersion techniques, interfacial bonding, and scalable manufacturing processes for graphene-polymer composites.

Emerging applications are particularly prominent in the automotive, aerospace, electronics, and energy sectors. In automotive manufacturing, graphene-enhanced polymers are being adopted for lightweight structural components, offering improved fuel efficiency and enhanced safety due to superior impact resistance. Companies like Ford Motor Company have initiated pilot projects incorporating graphene-polymer foams in vehicle parts to achieve noise reduction and thermal management benefits.

In the aerospace industry, the integration of graphene into high-performance polymers is enabling the development of lighter, more durable components that withstand extreme conditions. Airbus has reported ongoing trials with graphene-polymer composites for interior panels and structural reinforcements, aiming to reduce aircraft weight and maintenance costs.

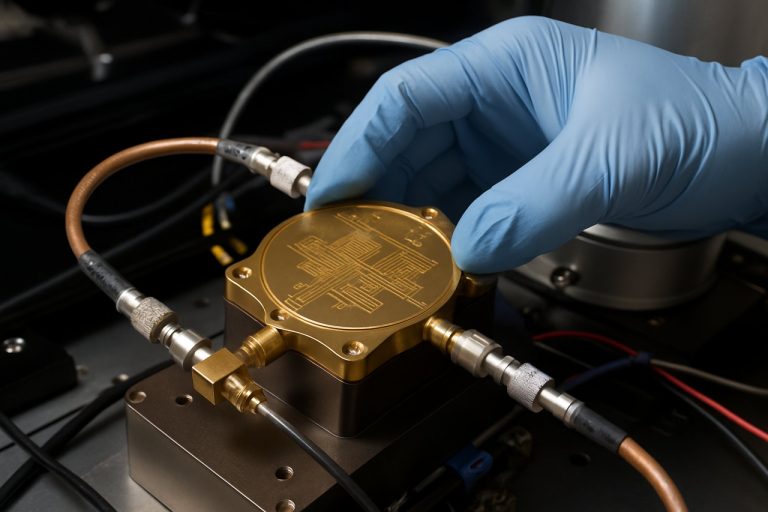

Consumer electronics represent another high-growth segment. Flexible displays, wearable devices, and advanced sensors are increasingly utilizing graphene-polymer films for their flexibility, transparency, and conductivity. Samsung Electronics and LG Electronics are exploring these materials for next-generation touchscreens and batteries, seeking to enhance device performance and durability.

Energy storage and conversion technologies are also benefiting from graphene-polymer integration. Supercapacitors and lithium-ion batteries with graphene-polymer electrodes demonstrate higher energy densities and faster charge-discharge cycles. Tesla, Inc. and Panasonic Corporation are among the industry leaders investing in R&D to commercialize these advanced materials for electric vehicles and grid storage solutions.

End-user insights indicate that while cost and scalability remain challenges, demand is driven by the need for multifunctional materials that combine lightweight properties with enhanced mechanical, electrical, and thermal performance. According to IDTechEx, end-users are prioritizing solutions that offer clear performance advantages and compatibility with existing manufacturing infrastructure, signaling a shift from laboratory-scale innovation to real-world adoption in 2025.

Challenges, Risks, and Barriers to Adoption

The integration of graphene into polymer matrices holds significant promise for enhancing material properties, but several challenges, risks, and barriers continue to impede widespread adoption as of 2025. One of the primary technical challenges is achieving uniform dispersion of graphene within polymers. Graphene’s tendency to agglomerate due to strong van der Waals forces can result in poor interfacial bonding and suboptimal mechanical, electrical, or thermal enhancements. Advanced functionalization and processing techniques are required, but these often increase production complexity and cost IDTechEx.

Scalability remains a significant barrier. While laboratory-scale demonstrations of graphene-polymer composites are promising, translating these results to industrial-scale production is challenging. Consistency in graphene quality, layer number, and defect density is difficult to maintain at scale, leading to variability in composite performance. Furthermore, the lack of standardized production protocols and quality benchmarks for graphene materials complicates supply chain reliability and end-user confidence MarketsandMarkets.

Cost is another critical factor. High-quality graphene production, especially via chemical vapor deposition (CVD) or liquid-phase exfoliation, remains expensive compared to conventional fillers. This cost premium limits the economic viability of graphene-polymer composites in price-sensitive markets such as automotive and consumer goods. Until production costs decrease and economies of scale are realized, adoption will likely be restricted to high-value applications in aerospace, electronics, and specialty coatings Grand View Research.

Regulatory and environmental concerns also pose risks. The long-term health and environmental impacts of graphene nanoparticles are not yet fully understood, raising questions about workplace safety, end-of-life disposal, and potential regulatory restrictions. The absence of clear regulatory frameworks for nanomaterials in many jurisdictions adds uncertainty for manufacturers and end-users Organisation for Economic Co-operation and Development (OECD).

- Technical challenges in dispersion and interfacial bonding

- Scalability and quality consistency issues

- High production costs relative to traditional materials

- Regulatory and environmental uncertainties

Addressing these challenges will require coordinated efforts in research, standardization, and regulatory development to unlock the full potential of graphene-polymer integration technologies.

Opportunities and Strategic Recommendations

The integration of graphene into polymer matrices presents significant opportunities for innovation across multiple industries in 2025. As graphene-polymer composites continue to demonstrate superior mechanical, electrical, and thermal properties, the market is poised for accelerated adoption, particularly in sectors such as automotive, aerospace, electronics, and energy storage.

One of the most promising opportunities lies in the development of lightweight, high-strength materials for automotive and aerospace applications. The use of graphene-enhanced polymers can lead to substantial weight reductions while maintaining or improving structural integrity, directly contributing to fuel efficiency and reduced emissions. Companies such as Airbus and Tesla have already initiated research collaborations to explore these advanced composites for next-generation vehicles and aircraft.

In the electronics sector, graphene-polymer integration enables the production of flexible, conductive films and components, which are critical for the advancement of wearable devices, flexible displays, and next-generation sensors. The unique combination of flexibility and conductivity offered by these composites is expected to drive new product categories and enhance existing technologies. For instance, Samsung Electronics has invested in R&D for graphene-based flexible electronics, aiming to commercialize these innovations by leveraging scalable polymer integration techniques.

Energy storage is another area where graphene-polymer composites offer strategic advantages. Enhanced conductivity and mechanical stability can improve the performance and lifespan of batteries and supercapacitors. According to IDTechEx, the market for graphene-enhanced energy storage devices is expected to grow rapidly, with polymer integration technologies playing a pivotal role in enabling mass production and cost reduction.

To capitalize on these opportunities, strategic recommendations for stakeholders include:

- Investing in scalable, cost-effective production methods for graphene-polymer composites, such as in-situ polymerization and solution blending, to meet industrial demand.

- Forming cross-industry partnerships to accelerate the commercialization of new applications, leveraging the expertise of both material scientists and end-user industries.

- Focusing on regulatory compliance and standardization, as outlined by organizations like ISO, to ensure product safety and facilitate global market entry.

- Prioritizing R&D in functionalization techniques that enhance graphene dispersion and interfacial bonding within polymers, thereby maximizing composite performance.

By addressing these strategic areas, companies can position themselves at the forefront of the rapidly evolving graphene-polymer integration market in 2025.

Future Outlook: Innovation Pathways and Market Evolution

The future outlook for graphene-polymer integration technologies in 2025 is marked by accelerating innovation and a maturing market landscape. As research transitions from laboratory-scale demonstrations to scalable industrial applications, several innovation pathways are emerging that are poised to redefine the performance and versatility of polymer composites.

One of the most significant trends is the development of advanced dispersion techniques. Uniformly distributing graphene within polymer matrices remains a technical challenge, but recent advances in functionalization and in-situ polymerization are enabling more consistent integration. Companies such as Directa Plus and Versarien are investing in proprietary processes that enhance graphene’s compatibility with various thermoplastics and thermosets, leading to improved mechanical, electrical, and thermal properties in end products.

Another key innovation pathway is the customization of graphene-polymer composites for specific industry needs. In the automotive sector, for example, lightweight yet strong graphene-enhanced polymers are being adopted to reduce vehicle weight and improve fuel efficiency. Ford Motor Company has already incorporated graphene-based foams in select vehicle components, and further expansion is anticipated as cost and scalability improve. In electronics, the integration of graphene into flexible polymers is enabling the next generation of wearable devices and flexible displays, with companies like Samsung Electronics exploring commercial applications.

Market evolution is also being shaped by regulatory and sustainability considerations. The European Union’s focus on sustainable materials and circular economy principles is driving demand for recyclable and environmentally friendly graphene-polymer composites. This is prompting manufacturers to develop greener production methods and to explore bio-based polymers as matrices for graphene integration, as highlighted in recent reports by IDTechEx.

- By 2025, the global graphene-polymer composites market is projected to reach over $500 million, with a compound annual growth rate (CAGR) exceeding 30%, according to MarketsandMarkets.

- Strategic partnerships between graphene producers and polymer manufacturers are expected to accelerate commercialization, as seen in collaborations between Graphenea and leading chemical companies.

- Emerging applications in energy storage, aerospace, and healthcare are likely to drive further innovation, with a focus on multifunctional materials that combine strength, conductivity, and barrier properties.

In summary, 2025 will see graphene-polymer integration technologies move closer to mainstream adoption, driven by technical breakthroughs, industry collaboration, and a growing emphasis on sustainability and application-specific solutions.

Sources & References

- MarketsandMarkets

- Directa Plus

- Versarien

- Graphene Flagship

- BASF

- IDTechEx

- Grand View Research

- Haydale Graphene Industries

- National Science Foundation

- Mitsubishi Chemical Holdings

- Airbus

- LG Electronics

- ISO