Thermochemical Methanation Technologies in 2025: Unleashing Next-Gen Synthetic Methane for a Decarbonized Future. Explore Market Dynamics, Innovations, and Strategic Opportunities Shaping the Industry.

- Executive Summary: Key Insights & 2025 Highlights

- Market Overview: Thermochemical Methanation Landscape and Drivers

- Technology Deep Dive: Process Innovations and System Architectures

- Competitive Analysis: Leading Players, Startups, and Strategic Alliances

- Market Size & Forecast (2025–2030): CAGR, Revenue Projections, and Regional Trends

- Application Sectors: Power-to-Gas, Industrial Decarbonization, and Mobility

- Policy, Regulation, and Incentives: Impact on Market Acceleration

- Challenges & Barriers: Technical, Economic, and Supply Chain Risks

- Future Outlook: Disruptive Trends and Investment Opportunities

- Appendix: Methodology, Data Sources, and Glossary

- Sources & References

Executive Summary: Key Insights & 2025 Highlights

Thermochemical methanation technologies are poised for significant advancement and deployment in 2025, driven by the global push for decarbonization and the integration of renewable energy sources into existing gas infrastructure. These technologies facilitate the conversion of hydrogen and carbon dioxide—often sourced from renewable electricity and industrial emissions—into synthetic methane, a process central to the production of renewable natural gas (RNG) and the realization of power-to-gas (P2G) concepts.

Key insights for 2025 indicate a marked acceleration in commercial-scale projects, particularly in Europe and Asia, where regulatory frameworks and incentives are fostering investment. The European Union’s REPowerEU plan and the ongoing support from organizations such as the European Environment Agency and European Biogas Association are catalyzing the deployment of methanation plants, with a focus on grid injection and sector coupling. In Asia, Japan and South Korea are advancing pilot projects to support energy security and carbon neutrality goals, with companies like Toshiba Energy Systems & Solutions Corporation and Korea Gas Corporation investing in demonstration facilities.

Technological innovation remains a cornerstone, with leading manufacturers such as thyssenkrupp AG and Siemens Energy AG refining catalytic reactor designs to improve efficiency, scalability, and integration with intermittent renewable power. The adoption of modular methanation units and advanced process controls is expected to lower capital costs and enhance operational flexibility, making these systems more attractive for both centralized and decentralized applications.

A critical highlight for 2025 is the anticipated increase in synthetic methane production capacity, with several flagship projects scheduled for commissioning. These include the expansion of the Audi e-gas plant in Germany and new initiatives under the Power-to-Gas Japan consortium. These developments are expected to demonstrate the commercial viability of thermochemical methanation, support grid balancing, and contribute to the decarbonization of hard-to-abate sectors such as heavy industry and transport.

In summary, 2025 will be a pivotal year for thermochemical methanation technologies, marked by increased investment, technological maturation, and the commissioning of landmark projects that will shape the future of renewable gas and energy system integration.

Market Overview: Thermochemical Methanation Landscape and Drivers

Thermochemical methanation technologies are gaining significant traction as a cornerstone in the global transition toward sustainable energy systems. These technologies facilitate the conversion of hydrogen and carbon dioxide into synthetic methane (CH4) through catalytic processes, offering a pathway for renewable energy storage, grid balancing, and decarbonization of hard-to-abate sectors. The market landscape for thermochemical methanation is shaped by a confluence of policy support, technological advancements, and the growing imperative to reduce greenhouse gas emissions.

A primary driver of market growth is the increasing integration of renewable energy sources, such as wind and solar, which generate surplus electricity that can be converted into hydrogen via electrolysis. This hydrogen, when combined with captured CO2 in thermochemical methanation reactors, produces synthetic methane suitable for injection into existing natural gas infrastructure. This process, often referred to as “Power-to-Gas,” is being actively promoted by European initiatives and regulatory frameworks, notably under the European Union’s European Commission renewable gas strategies.

Technological innovation is another key market driver. Companies such as thyssenkrupp AG and Siemens Energy AG are developing advanced methanation reactors with improved catalyst performance, higher energy efficiency, and modular designs that facilitate scalability. These advancements are reducing capital and operational expenditures, making thermochemical methanation increasingly competitive with conventional fossil-based methane production.

The market is also influenced by the need for sector coupling—integrating electricity, gas, and industrial sectors to enhance energy system flexibility. Thermochemical methanation enables the storage of renewable energy in chemical form, supporting grid stability and providing a renewable feedstock for industries such as chemicals and transportation. National gas grid operators, such as Energinet in Denmark and terranets bw GmbH in Germany, are piloting projects to demonstrate the technical feasibility and economic viability of large-scale synthetic methane injection.

Looking ahead to 2025, the thermochemical methanation market is poised for robust growth, driven by supportive policy environments, ongoing technological progress, and the urgent need for decarbonization solutions. Strategic collaborations between technology providers, utilities, and industrial end-users are expected to accelerate commercialization and deployment across Europe, Asia, and North America.

Technology Deep Dive: Process Innovations and System Architectures

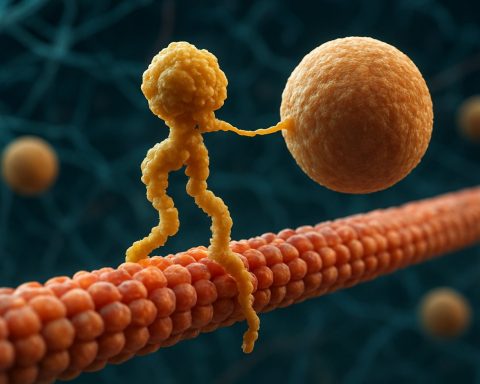

Thermochemical methanation technologies are at the forefront of renewable gas production, enabling the conversion of hydrogen and carbon dioxide into synthetic methane through catalytic processes. Recent process innovations have focused on enhancing efficiency, scalability, and integration with renewable energy sources. One significant advancement is the development of modular methanation reactors, which allow for flexible deployment and easier integration with variable renewable power inputs. Companies such as thyssenkrupp AG and Siemens Energy AG have pioneered compact reactor designs that optimize heat management and catalyst utilization, reducing operational costs and improving methane yield.

System architectures are evolving to support dynamic operation, crucial for coupling methanation units with intermittent renewable electricity. Innovations include the use of microchannel reactors, which provide superior heat transfer and enable rapid response to fluctuating feedstock flows. Helmholtz Association research institutes have demonstrated pilot-scale systems that maintain high conversion efficiencies even under variable load conditions, a key requirement for power-to-gas applications.

Catalyst development remains a core area of process innovation. Traditional nickel-based catalysts are being enhanced with promoters and novel supports to increase resistance to coking and sulfur poisoning, extending operational lifetimes. Research by Fraunhofer-Gesellschaft has led to the introduction of structured catalysts and washcoated monoliths, which improve mass transfer and reduce pressure drop, further optimizing reactor performance.

Integration with carbon capture and utilization (CCU) systems is another architectural trend. Methanation plants are increasingly designed to accept CO2 from biogas upgrading, industrial flue gases, or direct air capture, creating closed-loop carbon cycles. AUDI AG’s e-gas facility exemplifies this approach, linking renewable hydrogen production, CO2 capture, and methanation in a single, automated system.

Digitalization and advanced process control are also shaping the next generation of thermochemical methanation plants. Real-time monitoring, predictive maintenance, and AI-driven optimization are being implemented to maximize uptime and efficiency. As these technologies mature, they are expected to play a pivotal role in the large-scale deployment of synthetic methane as a renewable energy carrier.

Competitive Analysis: Leading Players, Startups, and Strategic Alliances

The thermochemical methanation sector is witnessing rapid evolution, driven by the global push for renewable energy and decarbonization. Leading players in this field are leveraging advanced catalysts, process integration, and digitalization to enhance efficiency and scalability. thyssenkrupp AG is a prominent player, offering large-scale Power-to-Gas (PtG) solutions that integrate methanation with hydrogen production, targeting industrial and grid-scale applications. Similarly, Siemens Energy AG has developed modular methanation systems as part of its broader hydrogen and synthetic fuel portfolio, focusing on flexible deployment and integration with renewable power sources.

Startups are injecting innovation into the market, often focusing on modularity, cost reduction, and niche applications. MicrobEnergy GmbH, a subsidiary of Viessmann Group, has pioneered compact methanation units suitable for decentralized biogas upgrading. ENEA (Italian National Agency for New Technologies, Energy and Sustainable Economic Development) collaborates with startups to pilot advanced reactor designs and novel catalysts, aiming to improve conversion rates and operational stability.

Strategic alliances are central to accelerating commercialization and scaling up. For instance, AUDI AG has partnered with Energy Research Centre of Lower Saxony (EFZN) and Sunfire GmbH to develop and operate the “e-gas” plant, which produces synthetic methane for mobility applications. ENGIE collaborates with technology providers and research institutes to integrate methanation into renewable gas grids, emphasizing sector coupling and grid balancing.

The competitive landscape is further shaped by joint ventures and public-private partnerships. The Fraunhofer Society leads several consortia, bringing together industrial and academic partners to advance reactor engineering and process digitalization. These collaborations are crucial for addressing technical challenges such as catalyst longevity, heat management, and dynamic operation under fluctuating renewable energy inputs.

In summary, the thermochemical methanation market in 2025 is characterized by a mix of established industrial leaders, agile startups, and robust strategic alliances. This dynamic ecosystem is accelerating the transition from pilot projects to commercial-scale deployment, positioning methanation as a key enabler in the renewable energy landscape.

Market Size & Forecast (2025–2030): CAGR, Revenue Projections, and Regional Trends

The global market for thermochemical methanation technologies is poised for significant growth between 2025 and 2030, driven by the increasing demand for renewable synthetic methane as a substitute for fossil-based natural gas. Thermochemical methanation, which converts hydrogen and carbon dioxide into methane via catalytic processes, is gaining traction as a key enabler for power-to-gas and sector coupling strategies in the energy transition.

According to industry projections, the thermochemical methanation market is expected to register a compound annual growth rate (CAGR) of approximately 18–22% during the forecast period. Revenue is anticipated to surpass USD 1.2 billion by 2030, up from an estimated USD 350 million in 2025, as commercial-scale projects and pilot plants move toward full deployment. This growth is underpinned by supportive policy frameworks in the European Union, where the European Commission has set ambitious targets for renewable gas integration, and by similar initiatives in Asia-Pacific and North America.

Regionally, Europe is projected to maintain its lead, accounting for over 45% of global market share by 2030. Countries such as Germany, the Netherlands, and Denmark are at the forefront, with national hydrogen strategies and funding programs supporting the deployment of methanation plants. For instance, Uniper SE and thyssenkrupp AG are actively involved in large-scale demonstration projects. In Asia-Pacific, Japan and South Korea are accelerating investments in power-to-gas infrastructure, leveraging thermochemical methanation to decarbonize their gas grids and industrial sectors. North America, led by the United States and Canada, is witnessing increased interest from utilities and energy companies, with pilot projects supported by organizations such as the U.S. Department of Energy.

Key market drivers include the declining cost of renewable electricity, advancements in electrolyzer and methanation reactor technologies, and the need for long-duration energy storage solutions. However, challenges such as high capital expenditure, catalyst durability, and integration with existing gas infrastructure remain. Overall, the outlook for thermochemical methanation technologies is robust, with regional trends reflecting a convergence of policy support, technological innovation, and market demand for renewable methane.

Application Sectors: Power-to-Gas, Industrial Decarbonization, and Mobility

Thermochemical methanation technologies are gaining traction across several key sectors as the global push for decarbonization intensifies. These technologies, which convert hydrogen and carbon dioxide into synthetic methane via catalytic processes at elevated temperatures, are being deployed in diverse applications, notably in power-to-gas systems, industrial decarbonization, and mobility solutions.

In the power-to-gas sector, thermochemical methanation plays a pivotal role in energy storage and grid balancing. Surplus renewable electricity is used to produce hydrogen via electrolysis, which is then combined with captured CO2 to generate synthetic methane. This methane can be injected into existing natural gas grids, providing a flexible and scalable means of storing renewable energy and decarbonizing gas supply. Projects such as Uniper’s methanation initiatives in Germany and ENGIE’s pilot plants in France exemplify the integration of methanation into national energy infrastructures.

For industrial decarbonization, thermochemical methanation offers a pathway to reduce emissions from hard-to-abate sectors. Industries such as chemicals, steel, and cement can utilize synthetic methane as a low-carbon feedstock or fuel, replacing fossil-derived natural gas. This approach not only curbs direct CO2 emissions but also leverages existing gas infrastructure, minimizing the need for costly retrofits. Companies like BASF and Siemens Energy are actively exploring methanation technologies to support their decarbonization strategies and to facilitate sector coupling between electricity, heat, and gas.

In the mobility sector, synthetic methane produced via thermochemical methanation is emerging as a sustainable alternative fuel for heavy-duty transport, shipping, and aviation. Its compatibility with current compressed natural gas (CNG) and liquefied natural gas (LNG) infrastructure allows for immediate deployment in existing fleets, reducing lifecycle greenhouse gas emissions. Initiatives by Shell and TotalEnergies are demonstrating the use of renewable methane in commercial transport and marine applications, supporting the transition to cleaner mobility.

As these sectors continue to evolve, thermochemical methanation technologies are expected to play an increasingly central role in enabling the large-scale integration of renewable energy, supporting industrial transformation, and advancing sustainable transport solutions.

Policy, Regulation, and Incentives: Impact on Market Acceleration

Policy frameworks, regulatory measures, and targeted incentives play a pivotal role in accelerating the deployment of thermochemical methanation technologies. These technologies, which convert hydrogen and carbon dioxide into synthetic methane, are increasingly recognized as essential for decarbonizing hard-to-abate sectors and integrating renewable energy into existing gas infrastructure. In 2025, the policy landscape is evolving rapidly, with governments and supranational bodies introducing measures to stimulate investment and market adoption.

The European Union has been at the forefront, embedding support for renewable and low-carbon gases within its EU Gas Market Directive and the EU Hydrogen Strategy. These frameworks prioritize the development of synthetic methane as part of the broader push for climate neutrality by 2050. The EU’s Effort Sharing Regulation and the European Green Deal further incentivize member states to adopt renewable gas solutions, including thermochemical methanation, through binding emissions targets and funding mechanisms.

National policies are also crucial. Germany’s National Hydrogen Strategy and France’s Stratégie nationale pour le développement de l’hydrogène décarboné both explicitly support Power-to-Gas and methanation projects, offering grants, feed-in tariffs, and pilot project funding. These incentives reduce financial risk and encourage private sector participation.

Regulatory clarity is equally important. The certification of renewable methane, grid injection standards, and guarantees of origin are being harmonized across Europe by organizations such as ENTSOG and CER, ensuring market access and consumer confidence. In addition, the International Energy Agency provides policy guidance and best practices to facilitate global harmonization.

Incentives are not limited to Europe. In the United States, the U.S. Department of Energy supports research, demonstration, and deployment of methanation technologies through grants and tax credits, particularly under the Inflation Reduction Act and related clean energy programs.

Overall, the interplay of policy, regulation, and incentives in 2025 is creating a more favorable environment for thermochemical methanation, driving investment, reducing costs, and accelerating market entry for these critical decarbonization technologies.

Challenges & Barriers: Technical, Economic, and Supply Chain Risks

Thermochemical methanation technologies, which convert hydrogen and carbon dioxide into synthetic methane via catalytic processes, face several significant challenges and barriers as they scale toward commercial deployment in 2025. These obstacles span technical, economic, and supply chain domains, each influencing the feasibility and competitiveness of methanation in the broader energy transition.

Technical Challenges: The core technical hurdle lies in catalyst performance and reactor design. Catalysts, typically based on nickel or ruthenium, are susceptible to deactivation due to sintering, carbon deposition, and poisoning by impurities in feed gases. Maintaining high activity and selectivity over prolonged operational periods remains a research priority. Additionally, the exothermic nature of the Sabatier reaction necessitates precise thermal management to avoid hot spots and ensure reactor stability, especially at larger scales. Integration with variable renewable hydrogen sources introduces further complexity, as methanation reactors must adapt to fluctuating input flows without compromising efficiency or catalyst life (BASF SE).

Economic Barriers: The economic viability of thermochemical methanation is closely tied to the cost of green hydrogen, which remains relatively high compared to fossil-derived alternatives. Capital expenditures for methanation plants, including advanced reactors and purification systems, add to the financial burden. Furthermore, the synthetic methane produced must compete with natural gas on price, which is challenging in regions with abundant and inexpensive fossil gas. Policy incentives, carbon pricing, and renewable energy mandates are therefore critical to bridging the cost gap and stimulating investment (Snam S.p.A.).

Supply Chain Risks: The supply chain for thermochemical methanation is exposed to risks related to the availability and price volatility of key materials, such as rare metals for catalysts and specialized reactor components. The rapid scale-up of electrolyzer and methanation plant manufacturing could strain existing supply chains, leading to bottlenecks or increased costs. Additionally, the secure and sustainable sourcing of renewable electricity and water for hydrogen production is essential, as any disruption upstream can impact methanation operations downstream (Siemens Energy AG).

Addressing these challenges requires coordinated efforts in research, policy, and industry collaboration to ensure that thermochemical methanation can play a robust role in decarbonizing gas grids and supporting renewable energy integration.

Future Outlook: Disruptive Trends and Investment Opportunities

The future outlook for thermochemical methanation technologies is shaped by several disruptive trends and emerging investment opportunities as the world accelerates its transition toward low-carbon energy systems. Thermochemical methanation, which converts hydrogen and carbon dioxide into synthetic methane via catalytic processes, is increasingly recognized as a cornerstone for power-to-gas applications, renewable energy storage, and decarbonization of hard-to-abate sectors.

One of the most significant trends is the integration of methanation units with renewable hydrogen production, particularly from electrolysis powered by wind and solar. This synergy enables the storage of excess renewable electricity in the form of synthetic methane, which can be injected into existing natural gas grids or used as a carbon-neutral fuel. Companies such as Siemens Energy and thyssenkrupp AG are actively developing integrated power-to-gas solutions, positioning themselves at the forefront of this market.

Another disruptive trend is the advancement of catalyst materials and reactor designs, which are improving the efficiency, scalability, and economic viability of methanation processes. Research and pilot projects led by organizations like Fraunhofer-Gesellschaft are focusing on novel catalysts that operate at lower temperatures and pressures, reducing operational costs and broadening the range of viable feedstocks, including biogenic CO2 sources.

Policy support and regulatory frameworks in regions such as the European Union are also catalyzing investment. The EU’s ambitious targets for renewable gas integration and carbon neutrality by 2050 are driving public and private funding into demonstration plants and commercial-scale projects. For instance, ENGIE is investing in large-scale methanation facilities as part of its renewable gas strategy.

Looking ahead to 2025 and beyond, investment opportunities are expected to expand in areas such as modular methanation systems for decentralized energy production, hybrid systems combining biological and thermochemical processes, and digitalization for process optimization. Strategic partnerships between technology providers, utilities, and industrial gas users will be crucial for scaling up deployment and reducing costs. As the technology matures, thermochemical methanation is poised to play a pivotal role in the global energy transition, offering both environmental and economic value for forward-looking investors.

Appendix: Methodology, Data Sources, and Glossary

This appendix outlines the methodology, data sources, and glossary relevant to the analysis of thermochemical methanation technologies in 2025.

- Methodology: The research employed a systematic review of primary literature, technical reports, and industry white papers published between 2020 and 2025. Data was collected from peer-reviewed journals, patent filings, and official documentation from technology developers and industry consortia. Comparative analysis was conducted to evaluate process efficiencies, catalyst performance, and integration with renewable energy systems. Where possible, data was cross-verified with pilot project results and demonstration plant reports.

- Data Sources: Key data sources included official publications from International Energy Agency (IEA), U.S. Department of Energy, and Fraunhofer-Gesellschaft. Technical specifications and performance data were referenced from leading technology providers such as thyssenkrupp AG and Siemens Energy AG. Industry standards and terminology were aligned with definitions from International Organization for Standardization (ISO) and DVGW (German Technical and Scientific Association for Gas and Water).

-

Glossary:

- Thermochemical Methanation: A catalytic process converting hydrogen and carbon dioxide into methane, typically using nickel-based catalysts at elevated temperatures.

- Sabatier Reaction: The principal chemical reaction (CO2 + 4H2 → CH4 + 2H2O) underlying thermochemical methanation.

- Power-to-Gas (PtG): A technology pathway that converts surplus renewable electricity into synthetic methane via water electrolysis and methanation.

- Catalyst: A substance that increases the rate of a chemical reaction without being consumed, crucial for efficient methanation.

- Integration: The process of coupling methanation units with renewable energy sources, CO2 capture systems, or existing gas infrastructure.

This structured approach ensures the reliability and relevance of the findings presented in the main report on thermochemical methanation technologies.

Sources & References

- European Environment Agency

- European Biogas Association

- Siemens Energy AG

- Audi e-gas plant

- European Commission

- Energinet

- terranets bw GmbH

- Helmholtz Association

- Fraunhofer-Gesellschaft

- Viessmann Group

- Energy Research Centre of Lower Saxony (EFZN)

- Sunfire GmbH

- European Commission

- BASF

- Shell

- TotalEnergies

- Effort Sharing Regulation

- National Hydrogen Strategy

- Stratégie nationale pour le développement de l’hydrogène décarboné

- ENTSOG

- CER

- International Energy Agency

- Snam S.p.A.

- International Organization for Standardization (ISO)

- DVGW (German Technical and Scientific Association for Gas and Water)