Table of Contents

- Executive Summary: 2025 Market Inflection Point

- Technology Overview: Zeolitic Voltammetry Sensor Fundamentals

- Key Industry Players and Strategic Alliances

- Breakthrough Innovations: Material and Design Advances

- Emerging Applications Across Key Sectors

- Current Market Size and 2025 Growth Drivers

- Forecast: Global Market Trends Through 2030

- Competitive Landscape and Intellectual Property Analysis

- Challenges, Regulatory Hurdles, and Sustainability Initiatives

- Future Outlook: Strategic Opportunities and Disruptive Potential

- Sources & References

Executive Summary: 2025 Market Inflection Point

The year 2025 marks a pivotal inflection point for zeolitic voltammetry sensors, as advances in material science, miniaturization, and system integration converge to drive both adoption and innovation. Zeolites—microporous aluminosilicate minerals—are increasingly engineered into nanostructured electrodes, enabling selective, sensitive electrochemical detection of ions and small molecules. This technology’s maturation is evident in several concurrent industry events and product launches.

Multiple sensor manufacturers are expanding their portfolios to include zeolite-integrated electrochemical platforms targeting environmental, biomedical, and industrial applications. In recent statements and product literature, Metrohm AG and Thermo Fisher Scientific Inc. have highlighted the integration of advanced porous materials—including zeolites—into their electroanalytical solutions, underscoring a commercial shift towards higher selectivity and longer operational lifetimes. Notably, Metrohm AG is advancing portable voltammetry analyzers designed for field analysis, leveraging zeolite-based electrodes for trace heavy metal and pesticide detection.

Furthermore, the intersection of zeolitic sensors with digital transformation initiatives is accelerating deployment in smart infrastructure and process automation. Companies such as Siemens AG are collaborating with sensor developers to embed zeolite-modified electrodes in industrial control systems, enabling real-time, in situ monitoring of chemical contaminants. This reflects a broader market trend toward connected sensors as part of Industry 4.0, with zeolitic voltammetry technologies offering distinct advantages in selectivity, durability, and miniaturization.

2025 also brings regulatory impetus: stricter EU and US standards for water quality and industrial emissions are catalyzing demand for next-generation sensors that can meet lower detection thresholds for heavy metals and organics. Zeolitic voltammetry sensors, with their proven performance in laboratory and pilot-scale settings, are well-positioned for scaled commercial deployment, especially as more suppliers, such as Thermo Fisher Scientific Inc. and Metrohm AG, announce partnerships with utilities and environmental agencies.

Looking ahead to the next few years, the outlook is robust: sensor miniaturization, cost reductions, and integration with wireless networks are expected to broaden the adoption of zeolitic voltammetry platforms across sectors. Strategic investments by established analytical instrumentation leaders, combined with regulatory momentum and digital infrastructure upgrades, signal a transition from niche research tools to indispensable components of environmental monitoring, healthcare diagnostics, and smart manufacturing ecosystems.

Technology Overview: Zeolitic Voltammetry Sensor Fundamentals

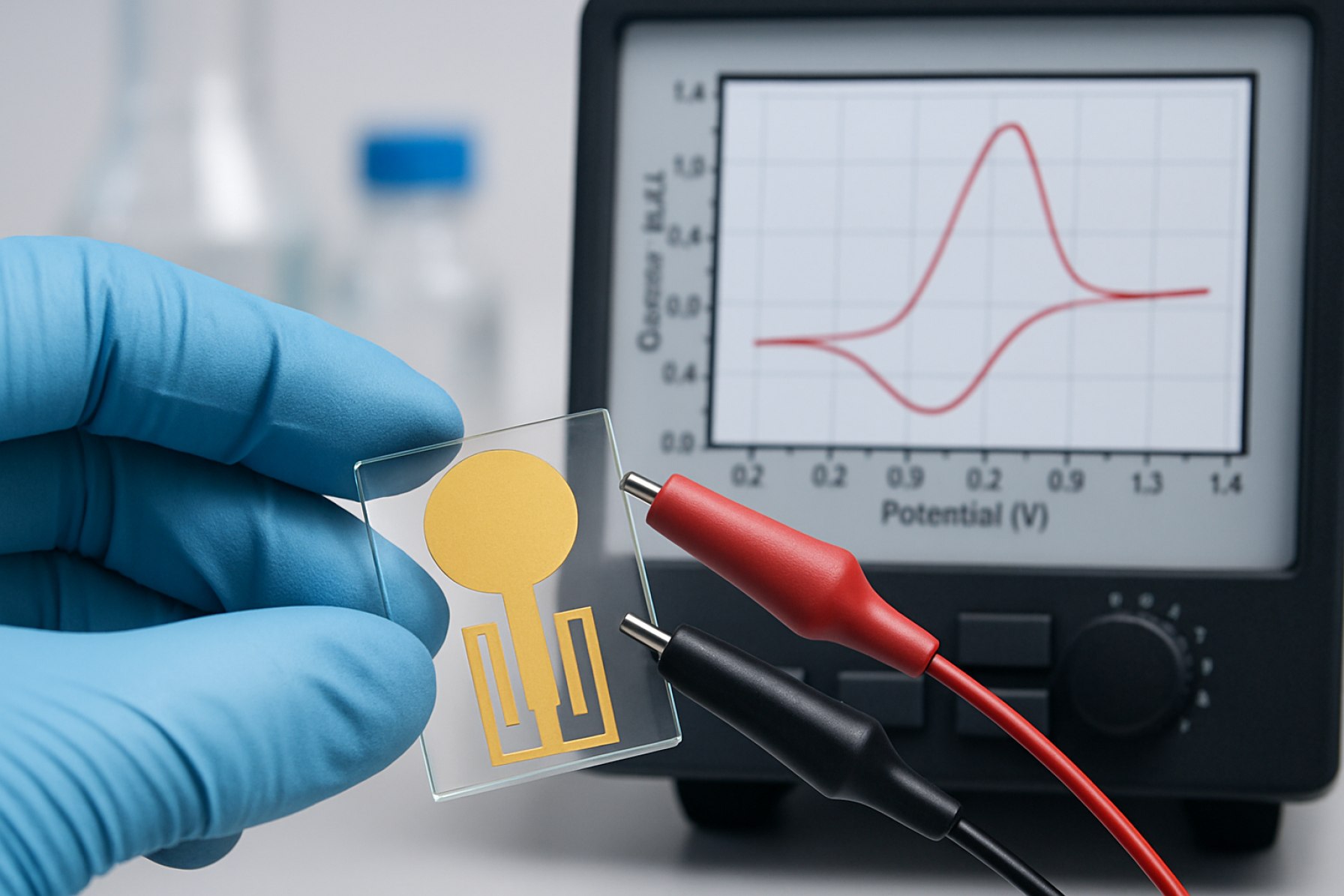

Zeolitic voltammetry sensors represent a convergence of advanced electrochemical sensing and porous material science, offering unique capabilities for selective and sensitive detection of various analytes. At the heart of these sensors are zeolites—crystalline aluminosilicates with well-defined pore structures and high surface areas—integrated as functional components within the sensor’s architecture. In 2025, research and development efforts continue to focus on enhancing the selectivity, stability, and miniaturization of these sensors for real-world applications in environmental monitoring, healthcare, and industrial process control.

The fundamental principle of zeolitic voltammetry sensors lies in the utilization of zeolites as ion-exchange matrices or molecular sieves that pre-concentrate target analytes at the electrode interface. This pre-concentration effect, combined with the controlled pore size and tunable surface chemistry of zeolites, enables discrimination among ions or molecules of similar size and charge—a significant advantage over conventional voltammetric sensors. Recent advances have leveraged synthetic zeolites with tailored pore geometries and surface modifications to further improve selectivity for heavy metals, small organic molecules, and biological markers. For instance, the incorporation of transition metal-exchanged zeolites has demonstrated enhanced electrocatalytic activity and redox cycling, broadening the sensor’s applicability spectrum.

A key technology trend in 2025 is the integration of zeolitic layers with micro- and nano-electrode arrays to enhance signal-to-noise ratios and enable multiplexed detection. Companies specializing in advanced materials and sensor platforms, such as Zeochem AG and Evonik Industries AG, are actively developing high-purity zeolite powders and membranes optimized for sensor fabrication. These materials are tailored for compatibility with emerging electrode materials—including carbon nanostructures and noble metals—allowing for robust sensor interfaces with improved lifetime and reproducibility.

On the manufacturing side, scalable synthesis of nano-sized zeolites and their integration into thin-film coatings are being realized through sol-gel and hydrothermal techniques. This supports the deployment of zeolitic voltammetry sensors in compact, portable formats suitable for point-of-care diagnostics and field environmental analysis. The outlook for the next few years anticipates increased adoption of these sensors in smart monitoring systems, underpinned by collaborations between zeolite producers and sensor technology companies. Industry players such as Honeywell International Inc. are engaged in innovation around sensor integration and data connectivity, signaling a shift towards networked, real-time analytical capabilities.

As the field progresses, the combination of material innovations, scalable manufacturing, and digital integration is expected to make zeolitic voltammetry sensors pivotal in next-generation analytical instrumentation, with strong prospects for both commercial and societal impact through enhanced analytical precision and operational efficiency.

Key Industry Players and Strategic Alliances

The competitive landscape of zeolitic voltammetry sensors is rapidly evolving in 2025, as established sensor manufacturers and advanced materials companies strengthen their portfolios to address growing demand for selective, high-sensitivity electrochemical detection. Enhanced collaboration across the value chain—from zeolite synthesis to sensor integration—is a hallmark of the current market, with organizations targeting applications in environmental monitoring, healthcare diagnostics, and industrial process control.

Major sensor manufacturers such as Metrohm AG and Hach Company have been advancing their voltammetry product lines by integrating novel zeolitic materials to improve analyte selectivity and sensor lifetime. These companies are leveraging proprietary zeolite modification techniques to tailor ion-exchange and adsorption properties, aiming to outperform conventional electrode materials in complex sample matrices.

On the materials supply side, leading zeolite producers like Arkema and BASF are expanding their zeolite portfolios to include grades engineered specifically for electrochemical applications. Their efforts include partnerships with university spin-offs and sensor startups to co-develop zeolite formulations optimized for voltammetric interfaces, further strengthening their market positions.

Strategic alliances are becoming increasingly prominent. For example, cross-industry collaborations between zeolite suppliers and sensor integrators are driving the co-design of next-generation sensors. In 2024–2025, several joint development agreements have been formalized, with companies such as Metrohm AG and BASF publicly announcing intent to co-create zeolite-functionalized electrodes for water quality monitoring and heavy metal detection.

Emerging players, often university spin-offs or startups specializing in advanced materials, are also entering the field. These entrants are attracting investment from established chemical and instrumentation firms, who view joint ventures or minority equity stakes as a route to accelerate innovation cycles. The trend is particularly visible in North America and Europe, where public-private innovation clusters are supporting pilot-scale production and field validation of zeolitic voltammetry sensors.

Looking ahead to the next several years, the sector is expected to see deeper integration between zeolite manufacturing know-how and sensor platform engineering. Industry observers anticipate that further standardization of zeolitic material properties and increased interoperability with digital data systems will drive new partnerships, especially targeting regulatory-driven markets such as water treatment and food safety.

Breakthrough Innovations: Material and Design Advances

Recent years have witnessed significant advancements in the development and deployment of zeolitic voltammetry sensors, driven by breakthroughs in material design and integration. As of 2025, the synthesis of highly crystalline and defect-engineered zeolite frameworks has enabled researchers and engineers to fine-tune ion selectivity and electron transfer properties, directly enhancing sensor specificity and sensitivity. Emerging techniques, such as hydrothermal synthesis and post-synthetic modification, are being utilized to create hierarchical pore structures, thereby improving analyte accessibility and diffusion rates.

In the context of sensor design, the incorporation of zeolites with various conductive substrates—such as carbon nanotubes, graphene, and noble metals—has become increasingly prevalent. This hybridization not only amplifies electrochemical signal transduction but also bolsters device robustness in complex sample matrices. Notably, companies specializing in advanced materials, such as BASF and Zeochem, have expanded their portfolio of customizable zeolitic materials, supporting sensor manufacturers with tailored products for diverse analytical applications.

One striking innovation lies in the integration of nano-sized zeolitic crystals directly onto microelectrode arrays. This approach, which leverages automated deposition and precise patterning, has paved the way for multiplexed detection systems adaptable to real-time monitoring scenarios. As a result, zeolitic voltammetry sensors are now being trialed for in situ water quality analysis, industrial process monitoring, and biomedical diagnostics, with prototypes demonstrating detection limits in the low nanomolar range for heavy metals and organic contaminants.

Automation and miniaturization are further shaping the outlook for the sector. Sensor modules featuring wireless data transmission and onboard signal processing are under active development, capitalizing on the stability and reusability of zeolitic interfaces. Companies like Metrohm and Thermo Fisher Scientific are investing in the commercialization of portable and modular sensor platforms, aiming to address the growing demand for rapid, on-site analytical tools in environmental and clinical settings.

Looking ahead to the next few years, the field is expected to benefit from the convergence of machine learning algorithms with sensor signal outputs, enabling more sophisticated pattern recognition and analyte discrimination. As global regulatory standards tighten around environmental monitoring and food safety, the adoption of next-generation zeolitic voltammetry sensors is projected to accelerate, with industry leaders and material innovators alike poised to capture emerging market opportunities.

Emerging Applications Across Key Sectors

Zeolitic voltammetry sensors, leveraging the unique ion-exchange and molecular sieving properties of zeolites, are witnessing expanding applications across multiple sectors in 2025. Recent progress in the synthesis and functionalization of zeolites has enabled their integration into advanced electrochemical sensor designs, leading to improved selectivity and sensitivity in challenging environments.

In the environmental monitoring sector, zeolitic voltammetry sensors are increasingly deployed for the detection of heavy metals and industrial pollutants due to their high affinity for specific ions and resistance to fouling. Enhanced aluminosilicate frameworks are providing robust platforms for on-site detection of trace contaminants such as lead, mercury, and cadmium in water sources. Companies engaged in zeolite materials production, such as Zeochem and BASF, are supplying tailored zeolite formulations optimized for sensor applications, supporting modular sensor development suited to regulatory and field requirements.

In the healthcare and biomedical diagnostics sector, the selectivity of zeolitic voltammetry sensors is being harnessed for the non-enzymatic detection of glucose and biomarkers in physiological fluids. The stability and biocompatibility of engineered zeolites facilitate integration into wearable and point-of-care sensor platforms, with ongoing collaborations between zeolite manufacturers and device developers. For instance, Honeywell and Evonik Industries have highlighted the role of specialty zeolites in supporting next-generation medical sensor architectures.

Industrial process control is another domain benefitting from zeolitic voltammetry sensors, particularly in the petrochemical and chemical manufacturing industries. Here, zeolite-based sensors are being utilized to monitor reaction intermediates, detect process impurities, and ensure product consistency. Companies such as Arkema are actively involved in supplying zeolites for these industrial applications, where durability under harsh process conditions is critical.

Looking forward, the outlook for zeolitic voltammetry sensors is robust. Ongoing investments in zeolite nanostructuring, surface modification, and hybrid sensor platforms are anticipated to drive further adoption across water quality monitoring, personalized health diagnostics, and smart manufacturing ecosystems. Partnerships between global zeolite suppliers and sensor technology firms are expected to intensify, fostering innovation and expanding commercial offerings for both established and emerging use cases through 2025 and beyond.

Current Market Size and 2025 Growth Drivers

The market for zeolitic voltammetry sensors in 2025 is expected to experience steady growth, driven by rising demand for advanced electrochemical sensing technologies in environmental monitoring, healthcare diagnostics, and industrial process control. Zeolites—microporous, aluminosilicate minerals—are increasingly being integrated into voltammetric sensors to enhance selectivity, sensitivity, and stability. Their unique ion-exchange capabilities and molecular sieving properties provide a competitive edge in applications where interference from complex sample matrices is a concern.

Recent data indicate that the value of the global voltammetry sensor market, including zeolitic variants, is being propelled by regulatory pressures for real-time pollutant detection and the broader adoption of point-of-care diagnostic tools. Environmental agencies worldwide are mandating stricter monitoring of heavy metals and organic contaminants in water and soil, fueling demand for zeolite-modified sensors that can offer low detection limits and high reproducibility. For instance, companies such as Metrohm AG and Thermo Fisher Scientific Inc. are expanding their portfolios of electrochemical analyzers, increasingly incorporating nanostructured and zeolite-based modifications to address emerging analytical challenges.

In healthcare, the push towards decentralized and minimally invasive diagnostics has accelerated research and commercialization of zeolitic voltammetry sensors for biomarker and metabolite detection. These sensors exhibit improved antifouling properties and can be tailored for selective detection of clinically relevant ions and molecules. Companies like Analytik Jena AG and Hach Company have demonstrated pilot deployments of zeolite-enhanced sensors for both clinical and environmental applications.

From a manufacturing perspective, advances in the scalable synthesis of zeolitic nanocomposites and their integration into electrode materials are lowering production costs and facilitating broader market penetration. Industry participants are investing in R&D collaborations with academic groups and scaling up pilot production lines to meet anticipated demand through 2025 and beyond. Furthermore, as sustainability becomes a key driver, the use of environmentally benign zeolite materials aligns with green chemistry initiatives in sensor manufacturing.

Looking ahead, the outlook for zeolitic voltammetry sensors remains positive, with double-digit growth rates projected in segments such as water quality monitoring and point-of-care diagnostics. The convergence of material innovation, regulatory momentum, and the need for rapid, sensitive detection will continue to shape the competitive landscape, positioning zeolitic voltammetry sensors as a pivotal technology in the evolving global sensor market.

Forecast: Global Market Trends Through 2030

The global market for zeolitic voltammetry sensors is poised for notable growth through 2030, driven by advancements in materials science, increased demand for high-selectivity electrochemical sensors, and expanding application areas. Zeolites—crystalline aluminosilicate materials with tunable pore structures—are being increasingly integrated into voltammetric sensor platforms to enhance selectivity, sensitivity, and operational stability in complex sample matrices. As of 2025, several leading sensor manufacturers and specialty chemical producers are scaling up research and commercial activities focused on zeolitic-modified electrodes, targeting applications in environmental monitoring, industrial process control, food safety, and healthcare diagnostics.

Current industry developments indicate that key players such as Zeochem and Honeywell are investing in zeolite synthesis and functionalization technologies to support sensor-grade materials with precise pore size distribution and surface chemistry. These materials are enabling next-generation voltammetry sensors capable of detecting trace-level analytes—including heavy metals, pesticides, and pharmaceutical residues—with improved selectivity compared to conventional electrode modifiers.

The transition from laboratory prototypes to commercial deployment is underscored by collaborative efforts between material suppliers, sensor manufacturers, and end-users. For example, Metrohm, a recognized provider of electrochemical instrumentation, and Thermo Fisher Scientific have both demonstrated interest in integrating advanced zeolitic materials into their sensor product lines, aiming to address regulatory demands for real-time, on-site analysis in water quality and food safety testing.

Market data from industry organizations suggest that the demand for miniaturized, portable, and cost-effective voltammetry sensors is accelerating, particularly in Asia-Pacific and North America, where industrial and environmental monitoring requirements are stringent. The expansion of smart manufacturing and digital process control is also fueling adoption, as zeolitic voltammetry sensors offer robust performance under harsh operating conditions, reduced maintenance needs, and compatibility with automated monitoring systems.

Looking ahead to 2030, the market outlook is characterized by the convergence of zeolite material innovation and sensor engineering, leading to broader adoption across sectors. Ongoing research to tailor zeolite frameworks for specific analyte interactions, coupled with advances in electrode miniaturization and wireless data integration, is expected to further enhance the value proposition of zeolitic voltammetry sensors. Industry collaborations, regulatory incentives, and increasing awareness of environmental and health monitoring will likely sustain double-digit growth rates in this niche but rapidly expanding segment of the global sensor market.

Competitive Landscape and Intellectual Property Analysis

The competitive landscape for zeolitic voltammetry sensors in 2025 is characterized by a convergence of materials science innovation and electrochemical sensing expertise among established sensor manufacturers, specialty chemical companies, and academic spin-offs. The market is still emerging, with patent activity intensifying since 2022 as companies recognize the potential of zeolite-modified electrodes for enhanced selectivity, stability, and miniaturization in challenging analytical environments.

Several industry leaders in sensor technology, such as Metrohm AG and Hach Company, have expanded portfolios to include advanced voltammetric solutions, although most current commercial offerings are based on carbon, noble metal, or metal oxide electrodes. These companies are increasingly exploring zeolite integration, as evidenced by collaborative projects with universities and dedicated R&D programs targeting improved ion-exchange and molecular sieving functionalities enabled by zeolitic frameworks.

In parallel, global zeolite manufacturers like Arkema and BASF have reported ongoing research into high-purity synthetic zeolites tailored for electronic and sensor applications, thus providing upstream support for sensor developers. Their ability to control pore size, surface properties, and chemical composition at scale gives sensor makers a competitive edge in customizing electrode surfaces for specific analytes. Start-ups and university spin-offs, particularly in Europe and Asia, are leveraging proprietary zeolite composites—often protected by patents focused on electrode fabrication processes, zeolite–metal hybrid structures, and sensor miniaturization techniques.

The intellectual property (IP) landscape is rapidly evolving. Patent filings have surged, notably in the US, EU, and China, with most applications centering on (1) novel zeolite synthesis routes for enhanced conductivity, (2) composite electrode architectures, and (3) integrated portable sensing devices. Companies aggressively defend process know-how and composition-of-matter claims, while cross-licensing and research partnerships are becoming common as the field matures. Leading sensor suppliers are also investing in freedom-to-operate analyses to ensure commercial viability and secure long-term supply agreements with zeolite producers.

Looking ahead, the next few years are expected to see increased commercialization, as zeolitic voltammetry sensors move beyond laboratory prototypes into regulated markets such as environmental monitoring, food safety, and medical diagnostics. The entry of major chemical and sensor corporations is likely to drive standardization, cost reductions, and broader IP enforcement, while open innovation models may foster further academic–industrial collaboration to accelerate sensor adoption and technical refinement.

Challenges, Regulatory Hurdles, and Sustainability Initiatives

Zeolitic voltammetry sensors, which harness the unique ion-exchange and molecular sieving properties of zeolites to enhance electrochemical sensing, are poised for broader adoption across environmental, industrial, and biomedical sectors in 2025. However, a number of critical challenges, regulatory considerations, and sustainability demands shape the trajectory of this technology.

One primary challenge remains the reproducibility and scalability of zeolite synthesis. Uniform pore structure and surface chemistry are essential for consistent sensor performance, yet batch-to-batch variability persists at industrial scale. Companies such as Zeolyst International and BASF continue to refine hydrothermal synthesis routes to deliver tailored zeolite frameworks for sensor applications, but further standardization is required as these materials transition from laboratory prototypes to commercially viable sensors.

Material integration and device miniaturization also present hurdles. Zeolites must be stably immobilized on electrode surfaces without compromising electrical conductivity or mechanical integrity. Efforts led by sensor manufacturers like Metrohm and Thermo Fisher Scientific focus on developing hybrid electrodes and scalable deposition techniques, yet balancing zeolite loading and sensor responsiveness remains a key technical bottleneck.

From a regulatory perspective, zeolitic voltammetry sensors designed for environmental monitoring and clinical diagnostics must navigate increasingly stringent requirements. In the European Union, REACH regulations and the Medical Device Regulation (MDR) framework demand extensive material safety and biocompatibility data for new sensor materials. Manufacturers such as Siemens are investing in comprehensive toxicological testing and third-party validation to address these requirements. Moreover, the U.S. Environmental Protection Agency’s ongoing scrutiny of novel sensing materials for water quality monitoring compels sensor developers to demonstrate robust performance, selectivity, and minimal risk of leaching or contamination.

Sustainability initiatives are gaining momentum within the zeolitic sensor supply chain. The use of naturally occurring or recycled aluminosilicate sources for zeolite synthesis is being advanced by firms including Arkema, aiming to reduce resource intensity and carbon footprint. Further, companies are exploring additive manufacturing and green chemistry approaches to minimize energy consumption and chemical waste during both zeolite and sensor fabrication. Life cycle analysis and environmental impact assessments are also becoming standard practice, driven by customer demand for eco-friendly sensing solutions.

Looking ahead, sector leaders anticipate that success in standardizing zeolite materials, meeting regulatory benchmarks, and embracing circular production models will determine the competitiveness and societal impact of zeolitic voltammetry sensors in the coming years.

Future Outlook: Strategic Opportunities and Disruptive Potential

The future outlook for zeolitic voltammetry sensors is marked by a confluence of emerging market needs, advances in materials science, and strategic shifts among sensor manufacturers. As the demand for real-time, selective, and portable electrochemical sensing intensifies across sectors like environmental monitoring, healthcare diagnostics, and industrial process control, zeolite-modified electrodes are gaining traction for their remarkable ion-exchange properties, high surface area, and tunable frameworks.

In 2025 and the years immediately ahead, several strategic opportunities are poised to redefine this landscape. First, the integration of zeolitic materials with advanced nanostructures and conductive matrices is expected to yield sensors with enhanced sensitivity and chemical selectivity. This is of particular interest to companies specializing in environmental monitoring and water quality, where the detection of trace heavy metals, ammonia, and organic contaminants is critical. Leading sensor manufacturers, including Metrohm and Hach Company, have expressed ongoing investment in novel electrode materials and miniaturized platforms, suggesting that zeolitic voltammetry sensors may soon be incorporated into mainstream commercial offerings for field applications.

On the technical front, disruptive innovation is likely to come from the coupling of zeolitic electrodes with microfluidics and wireless data transmission. These integrations enable the design of compact, user-friendly devices suitable for decentralized diagnostics—a trend already being explored by research divisions at established electrochemical sensor companies such as Thermo Fisher Scientific. With the Internet of Things (IoT) expansion, smart sensors leveraging zeolitic modification are positioned to provide continuous, remote monitoring capabilities, particularly in resource-constrained or hazardous environments.

The medical diagnostics sector also presents a high-growth opportunity. Zeolitic voltammetry sensors have demonstrated potential for non-enzymatic biosensing, for example in glucose or uric acid detection. Such applications could be strategically attractive to companies developing next-generation point-of-care devices. Partnerships between zeolite producers and biosensor manufacturers, such as those involving Zeochem, may accelerate the commercialization of these disruptive platforms.

Looking ahead, regulatory trends favoring rapid, on-site analytical methods and the rising emphasis on sustainability further underpin market potential. However, challenges remain in the large-scale reproducibility and long-term stability of zeolitic-modified electrodes. Addressing these hurdles through collaborative R&D will be key to capturing future growth. Overall, the strategic trajectory for zeolitic voltammetry sensors points toward high-value, cross-sector integration, with significant disruptive potential in both analytical instrumentation and real-world monitoring solutions.